Author: cheqdin

Published Date: September 05, 2019

Invoices are records of purchase that allow your customers to pay you for the goods and services you provided them. They can also double as legal tax documents and serve as the all-important tax receipts when it comes to filing your tax returns.

Depending on the context and purpose they are used for, invoices take on different names and formats. Here’s a quick look at some of the common types of invoices:

1. Full Invoice

The full invoice is the most comprehensive form of invoice and would typically cover all pieces of information about a sale. They are generally used by VAT-registered businesses and are a legal requirement when the amount of transaction is a large sum and over a certain sales threshold.

As these invoices also act as proof of the revenue you earned and the tax you collected for the government, they should typically contain the following pieces of information:

- Your business name and address

- The name and address of your customer

- A unique invoice reference number that can only be applied to that specific invoice

- The date on which the invoice was raised

- An itemised list of the services you have provided

- The amount of sales tax charged for each item or the total tax for the whole invoice

- The total invoice amount

- The payment terms detailing the invoice due date, number of instalments, payment methods etc

- Your VAT number and company number

2. Simplified Invoice

This is a pared-down version of the full invoice and suited for smaller transactions that fall below the sales threshold for your country. This simplified format is widely used by childcare providers and businesses that are not registered for VAT.

- Your business name and address

- A unique invoice number

- Date

- An itemised list of goods/services provided

- The total invoice amount

- The payment terms and details including payment date and methods

- Your VAT number (if you have one)

3. Past Due Invoice

If your customer doesn’t pay you by the due date on your invoice, you send them a 'past due’ invoice. This invoice would detail all the information you included in your final invoice, plus any additional charges or penalties for late payments.

4. Recurring Invoice

This is the invoice you send your customer periodically based on a billing interval you agreed with the customer, and the invoice amount typically remains the same for each.

5. Credit Note or Credit Memo

A credit note is issued when your customer has paid an invoice, and you are required to return the full payment or part of the amount. This could be due to an error in the invoice or because your customer requested a refund.

Instead of charging your customer, the credit note serves as an acknowledgement that you owe money to your customer. It will have all the information as a regular invoice, but with a 'credit note reference number' instead of an 'invoice reference number.’

With Cheqdin's invoicing system, childcare providers can apply a credit note to a sent invoice to ensure there are no missing pieces in your records when your accountant gets to work.

Invoicing is a tedious process, and especially so for childcare businesses due to the high variability in each child’s booking pattern. Add to it the wide range of variables such as funded hours, ad-hoc sessions and optional extras that need to be factored in each time, invoicing requires a high level of accuracy and attention to detail.

If the entire process of invoicing seems like a lot of work (as it indeed is!) - the best route forward is to go for an invoicing tool that automates the process for you.

What can Cheqdin do for you?

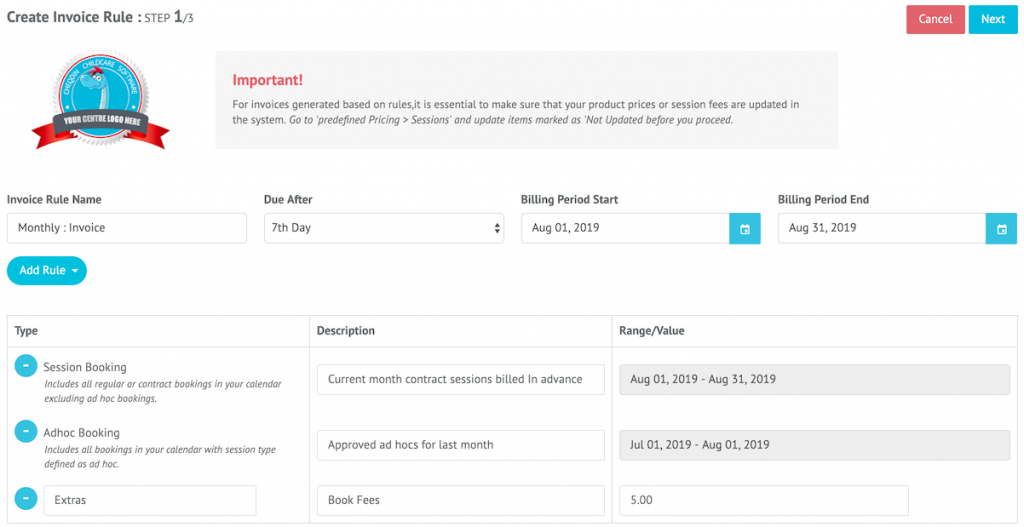

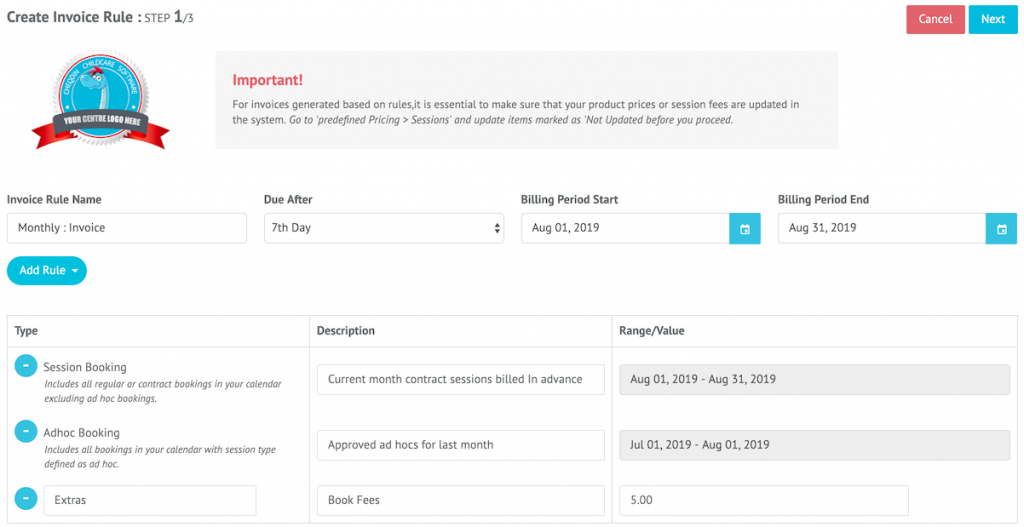

Cheqdin automatically generates recurring and ad-hoc invoices and gives you the flexibility to create invoices in groups – based on the common criteria you specify for a group. Cheqdin will pull out information from your bookings records and will have the full batch of invoices ready for you within minutes.

For instance, if you are looking at generating Augusts’ invoices for all children who took extra ad hoc sessions for July, you can do it in a few clicks by specifying these rules and selecting the children you want to apply it to. The system will automatically fetch the details from your records and generate invoices for that category instantly.

The entire idea is to save you time and trouble and make it easier for your customer to pay you on time.

Interested in giving it a try? Please feel free to sign up for our free trial or schedule a free demo with our product expert.

You might also like:

Automating Nursery Fee Collection: What are your options? >View Article

8 Reasons Why Preschools and After-School Clubs Should Use Direct Debit >View Article